Milo S-P

Renting Out Your Tinyman LP Tokens?? Understanding The Possibilities Of NFT Renting

Understanding the possible use cases of renting NFTs

As the world of non-fungible tokens (NFTs) continues to grow and evolve, one trend that has emerged is the ability to rent these unique digital assets. NFTs are digital assets that are unique and indivisible, meaning they cannot be replicated or divided like traditional cryptocurrencies. This makes them ideal for ownership of unique items like collectibles, art, and even virtual real estate.

Renting NFTs allows individuals and organisations to use these unique digital assets without having to purchase them outright. This can be especially useful for those who may not have the financial means to purchase an NFT, or for those who only need temporary access to an NFT.

Rent NFTs

To rent an NFT, the owner of the NFT must first agree to make it available for rent. This can be done through a variety of means, such as through a marketplace or via a direct agreement with the NFT owner. Once the owner has agreed to make the NFT available for rent, the renter can then pay a fee to gain temporary access to the NFT.

The listing parameters of a NFT rental contract will include:

- The daily rate, this is how much per day the lender requires you to rent the asset; typically the cost of the contract duration will be paid up front and not each day.

- The duration of the rental agreement, in days. Usually it should be no longer than 180 days, it depends on the platform whether there will be refund for the days not used in the contract.

- The deposit or lack of. Not every NFT rental arrangement requires a deposit, this is the downpayment provided by the renter and held in escrow until the asset is returned. If the NFT is not returned the escrow will trigger a liquidation function and release the borrower’s deposit back to the lender.

Benefits

One of the key benefits of renting NFTs is the cost savings compared to purchasing the NFT outright. Renting an NFT allows individuals and organisations to use the digital asset without incurring the full cost of ownership. This can be especially useful for those who may not have the financial means to purchase an NFT, or for those who only need temporary access to the NFT.

Another benefit of renting NFTs is the ability to try before you buy. Many individuals and organisations may be unsure if they want to purchase an NFT, and renting the NFT can provide them with the opportunity to use it and see if it fits their needs before committing to a purchase.

Drawbacks

There are also potential drawbacks to renting NFTs. For example the value of the NFT may increase or decrease during the rental period, which could affect the decision to purchase the NFT. This could result in theft of the digital asset as the new value of the NFT could outweigh borrower’s deposit.

The Issue Of Over Collaterisation

Another issue, less spoken about is the over-collateralisation of rental agreements. Essentially this means the lender is asking for sometimes 150-200% the value of the asset to rent it out. This can deter people from borrowing it.

Solutions to this include perhaps offering trust scores and counting the renter’s successful number of assets returned. In this way borrowers who have consistently returned NFTs in the past get access to listings that require lower collateral parameters. Perhaps the platform could even cover a portion of the deposit to encourage renting.

Another solution would be to integrate a borrower’s deposit with their DeFi lending protocol.

There two points here:

- Plug the deposit in to DeFI so that it can earn a yield and also encourages longer rental periods .

- Use the renter’s DeFi positions as their collateral for any rentals. I believe this is similar to liquid governance currently on Algofi and Folk’s Finance. Essentially the borrower never needs to pay a deposit because his assets on the lending protocol can actual be called upon if he doesn’t return the asset. This would boost rentals massively and the borrower is still earning APY on his assets.

Non Collateralised Lending

This is a rental contract that requires no deposit.

This type of lending is can be based on the creditworthiness of the borrower rather than on the value of their assets.

It may not require a deposit for various reasons.

- The borrower will receive a wrapped asset. This is actually a copy of the original NFT but just a temporary copy that will be burned after the fake is returned. Now this is popular with some but wrapped assets can’t be used as real in game assets, for example.

- You have good credit or track record of paying back NFTs.

- The lender may not require one because the NFT actually has no value but the utility is access to xyz…

Use Cases Of Renting

*The attendees of the first Algorand conference, Decipher, received an AlgoGator NFT which gave them a discount for this year event. If you couldn’t attend wouldn’t it be great to lend out the ticket to someone else to utilise ?

*The attendees of the first Algorand conference, Decipher, received an AlgoGator NFT which gave them a discount for this year event. If you couldn’t attend wouldn’t it be great to lend out the ticket to someone else to utilise ?

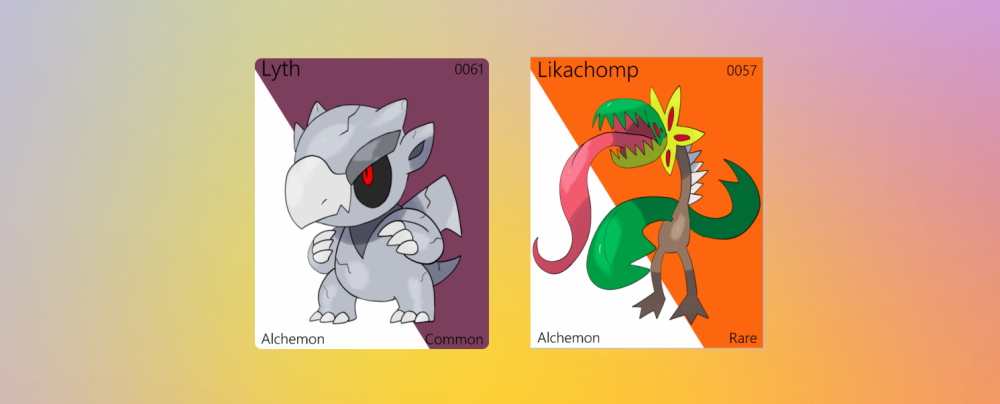

Gaming NFTs

The only NFTs with actual utility are arguably gaming NFTs. This is because when you own these assets it allows access to play the game and can offer an improved game play experience along the ability to earn rewards. This means there’s a huge market to boost the on-boarding in play-to-earn games as the barrier to entry is now much lower. Moreover it offers an income opportunity to token holders as when they are not playing they can temporarily relinquish their ownership, for a fee, and pass on the utility to someone else. A true mutualistic relationship.

Digital Art

Digital art is a good, but niche example. Its perfect for galleries or online exhibitions to borrow NFTs off collectors temporarily whilst respecting ownership rights. It could also be great to flex online to temporarily borrow an NFT to show off as your pfp.

Some digital art NFTs also gives holders exclusive access to games, servers and cool features in the project’s website that are now even more tempting to visit because of renting functionality. I can see what all the fuss is about without having to spend the full price. Where do I sign up?

Education & On-boarding Into Web3

Renting digital assets allows users, who are new to web3, to come into the space and borrow a NFT and can experience that feeling of ownership, even if it just for a day.

LP Tokens

You could receive a more consistent income off your LP tokens in a DeFi pool by renting them out to someone who has less capital and can make their margin speculating 24 hour trading fees. Bizarre I know but I’ve done it.

Conclusion

Ultimately, renting NFTs can be a useful option for individuals and organisations looking to use unique digital assets without incurring the full cost of ownership. While there are potential drawbacks, the cost savings and ability to try before you buy make renting NFTs an attractive option for many.

There are several NFT rental platforms due to launch on Algorand in Q1/Q2 ’23

This article is an Algorand digital asset purchased through the Tokenblogs.app platform and origianlly authored by Milo S-P

*All articles published on the Shufl.app website are the opinions of the author. As opinion pieces they may not reflect the opinions of Shufl Inc. These articles are created purely for entertainment and informational purposes only and do not constitute investment advice. Cryptocurrency and NFTs are highly volatile assets and you should always do your own research before making any investment.